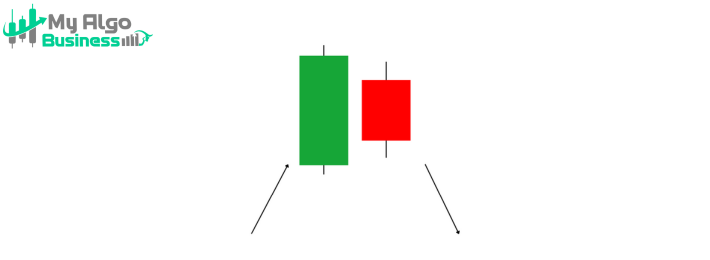

The Bearish Harami is a reversal pattern that signals a potential change in trend from Bullish to bearish. It consists of two candles, with the second candle being a small body (typically a red or bearish candle) completely contained within the body of the first candle (usually a Bullish or green candle). This pattern suggests that the upward momentum is weakening and that sellers might take control.

• A long green (Bullish) candle, indicating that buyers are in control and the price has been rising. This candle typically confirms the current uptrend.

2. Second Candle (Bearish)• A small red (bearish) candle that completely fits within the body of the first candle. The open and close of the second candle must be inside the range of the first candle’s open and close, indicating that momentum is slowing and sellers may be starting to take control.

✅ The second candle must fit completely within the body of the first candle.

✅ The first candle is Bullish (green), and the second candle is bearish (red).

✅ Appears at the top of an uptrend, signapng a possible trend reversal.

✅ The second candle is small, showing that the buying pressure is weakening.

• The first Bullish candle shows that buyers have been in control, and the price has been moving higher.

• The second candle is a smaller bearish candle that fails to break the range of the first, showing that buying pressure is weakening, and the sellers are beginning to push back.

• The Harami pattern suggests indecision in the market, and the smaller second candle indicates that a shift in momentum could be coming.

📌 Entry: After the second bearish candle closes, confirming the weakening of the uptrend. Some traders wait for the next candle to confirm the reversal (e.g., a close below the second candle's low).

📌 Stop-loss: Above the high of the first candle (or the second candle if more conservative).

📌 Target: Next support level or based on a risk-reward ratio (e.g., 2:1).

The Bearish Harami is a strong trend reversal signal, and when combined with volume confirmation and the occurrence at key resistance levels, it can be a powerful pattern.